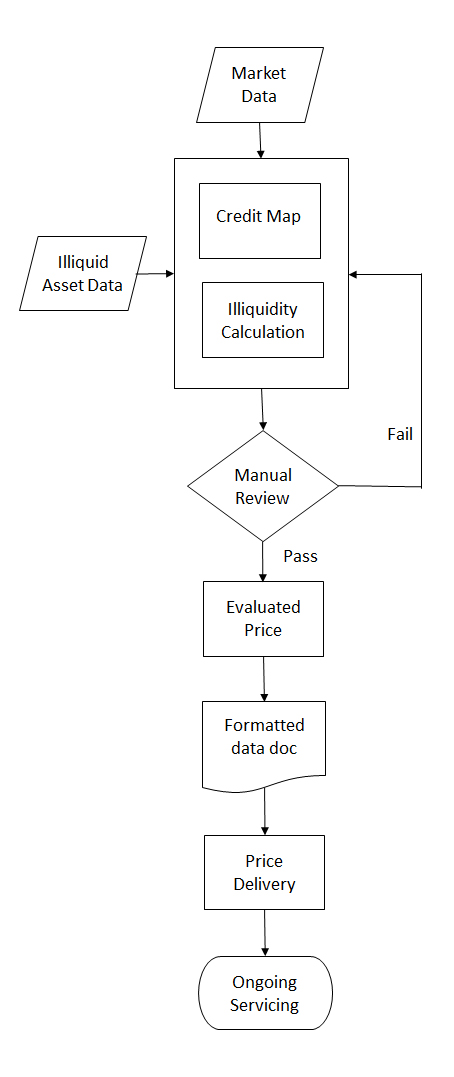

Step by step pricing process

1. Data Sourcing, screening and mapping

Our first step is to build and maintain the credit map for every sector that we cover. We access multiple data sources including FINRA, ESMA, MSRB, buy-side pricing, sell-side pricing and third party runs.

Each data point is screened for reliability and relevance. All sourced pricing is placed into Corvid’s credit map using multiple factors such as Issuer, rating, jurisdiction, tenor, sector, sub-sector, currency and structure. Once assigned a position in our credit universe, each data point is applied to one or more of Corvid’s 500+ credit curves. These credit curves then become the credit map upon which we place our illiquid assets for comparison.

2. Illiquid asset assessment

Each illiquid asset we value is reviewed using the same criteria in our data screening and mapping process. It is then assigned a position within the Corvid credit map and is reviewed by our valuations team to ensure each asset is placed correctly on the credit map.

For more complex structured products, pricing models are built specific to each security. Models are built by our specialist modelling team in conjunction with the client. Each model is actively maintained and updated with all new data being incorporated as soon as it becomes available.

3. Evaluated Margin

Once an asset is placed within our credit map, our valuations team calculates what they believe is a suitable return for the asset under current market conditions and assuming a sales process over a fixed period. Depending on the nature of the asset, this process will take a number of forms;

For example, for vanilla, senior unsecured transactions, direct comparison are made to the assets six closest comparisons on our credit map. Comparisons are weighted in relation to their similarity to the asset being valued and the quality of pricing data available. So a comparison asset issued by the same entity with the same ranking and similar maturity will carry a higher weighting than an asset from the same jurisdiction, asset class and rating but issued by a different firm.

4. Illiquidity factor

In addition to placing each asset into our credit map, we carry out a liquidity analysis to determine the reasons behind an assets illiquidity and the likely effect that will have on the market price of that asset. This process is carried out manually by our team of illiquid credit specialists who look at the underlying market appetite for the asset under normal market conditions.

Illiquidity comes in many forms. Large transactions held by a small number of investors may be illiquid because securities rarely come up for sale. Other transactions may be bespoke in nature and have structural and legal quirks that limit the potential investor universe. It can be argued that there are as many types of illiquidity as there are illiquid assets.

Corvids Illiquidity factors come in the form of additional margin required by the market to hold the illiquid asset over a liquid alternative. This factor is then combined with the evaluated margin calculation to give us a market return number.

5. Evaluated Price

Only after combining all of the pricing elements above do we then generate an evaluated price for each asset. Pricing methodologies are asset specific and mirror the widely accepted techniques used by institutional investors for each asset class.

6. Price Delivery

Pricing is formatted to each client’s requirements and can be delivered through multiple channels including SFTP, Bloomberg, email, web services and other platforms.

7. Customer Service

Each client has direct contact with a dedicated relationship manager to help with any queries about our pricing process. The Corvid service also includes on-demand price challenging. Clients deal directly with the relevant pricing team on any price challenges. Price challenges are treated with priority and we target a turnaround time of under 24 hours for resolution of all queries.

All pricing models are automatically reviewed quarterly but clients can request a model review ahead of schedule if there is a change in underlying market assumptions or a question around the accuracy of the model being employed.